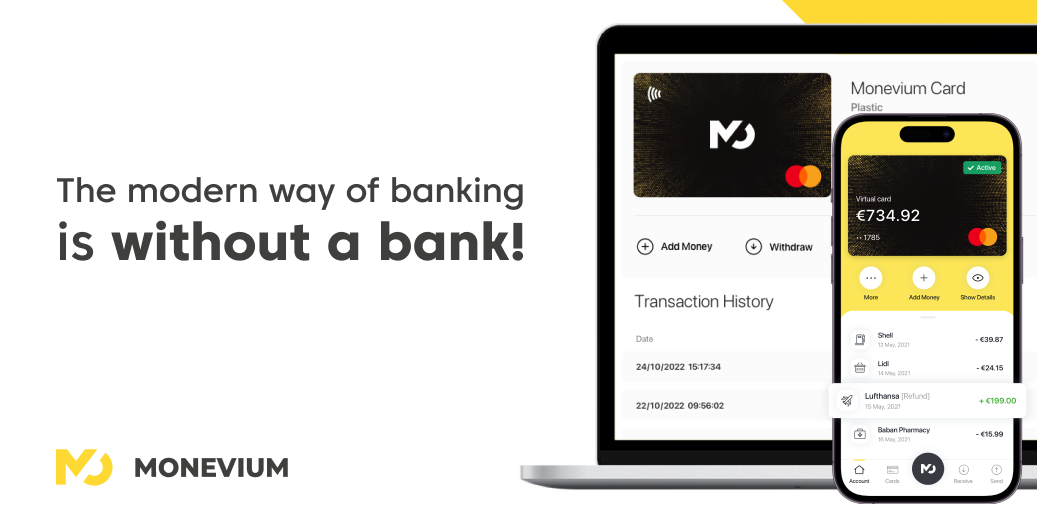

The modern way of banking is… without a bank!

Not so long ago, there was a time when traditional commercial banks were the central point of national economies.

Private individuals, small businesses and large corporations relied on a relatively unchanged hierarchy in which the bank holds all the cards for generations.

In some Western nations, reliance on commercial banks dates back as far as before the industrial revolution.

This is a remarkable dynamic. In all that time, there has not been a considerable evolution in the method by which banks operate, yet the entire world has changed significantly and keeps changing at an ever-increasing pace.

It is quite fascinating to consider any industry which has such a massive bearing on global society and commerce as banks do, continuing along relatively unaltered methodology for even 15 years, let alone over 200.

Yes, modern banking includes the use of electronic transfers and allows transactions to be conducted via the internet. It also allows contactless payments and paperless statements, but underneath the scant façade of modernity lies a behemoth in which processes have not changed since everything was done using a pen and paper.

This is why in today’s highly advanced, borderless world, more businesses and private individuals are choosing technologically advanced non-bank solutions instead due to their suitability to modern life and business.

Doing away with delays and costs

One aspect in which nothing has changed for several decades is the method by which international bank transfers take place.

Often, banks use the SWIFT messaging system, which dates back 50 years, and acts as a carrier of the messages containing the payment instructions between financial institutions involved in a transaction.

This network routes requests made by customers of banks in order to settle a foreign currency transaction. Most people who have made payments to anyone overseas will have likely used the SWIFT system via their bank.

Most banks using this system have no affinity with the recipient bank and do not perform clearing or settlement functions; therefore, funds are routed via correspondent banks, where they are often traded on the Forex market before being deposited in the recipient’s account minus often high fees, between three and five days after being sent.

This procedure has been the same for half a century.

In today’s world, where the internet has made everything instant, surely instant access to funds with lower fees and no middleman is more favourable?

It is clear that large banks have the wealth and staff numbers to tackle the disruptive potential of fintech startups, but their responses have been either dismissive or passive.

Meanwhile, the non-bank fintech sector does not have the legacy systems, and fear of revolutionising how banking works insofar as keeping old practices and simply building on top of them is the method most banks take.

It is widely recognised that most procedures within banks are obsolete and fragmented. They include manual and institutionalised processes that were developed over many decades, very slowly, during the pre-internet age; thus, the status quo is that of obsolescence. These have increased the prices and bureaucracy that consumers face. By the beginning of this decade, only 7% of credit products in banks could be handled digitally from end to end (by recent analysis by Bain and SAP).

No bureaucracy, no old systems, and no delays

Non-bank firms which use technology to develop solutions for modern-day financial services have been rapidly growing in number and popularity, mainly due to their lack of legacy policy and suitability to modern life.

Monevium, for example, does not perform draconian credit checks on its applicants, instead providing everyone, regardless of status, with an account and pre-paid card, with which instant transactions can be made across Europe, with significantly lower costs than many traditional methods.

Additionally, transferring funds to recipients in Europe is quick and effective, which is important in an increasingly international world.

A Euro-denominated IBAN current account can be opened online within minutes to receive and send funds worldwide, in a fast, easy and efficient way, without the painstaking onboarding procedures undertaken by traditional banks, and there are no monthly fees for holding such an account.

Inclusivity and empowerment are key topics

Aside from the modernity required by today’s consumers and business owners, traditional financial products are becoming less accessible to most people as inflationary currencies, and economic crises have blighted the Western economies for over a decade.

Acceptance criteria have become very strict by most banks, and fewer products are available to increasingly fewer people.

Unlike a traditional bank, anyone over the age of 18 living in the European Economic Area can open a Monevium IBAN account, regardless of citizenship or financial history, without any lengthy credit checks. A personal Monevium account can be opened within minutes and is totally free to open and maintain.

Also, Monevium does not re-invest customer funds and protects and safeguards your funds by keeping all the customer money separate from its company finances.

The future is yours. It is one of empowerment and inclusivity; and of quick and easy methods of going about everyday life, regardless of location, status or means.

Monevium is the Trading Name of Advanced Wallet Solutions Limited, a company registered in the UK under company number 10251711 and is regulated by the UK’s Financial Conduct Authority under Firm Reference Number 766038.

Open Monevium Account in Minutes

The future of money management is only a few clicks away. Apply here to have complete control over your money.